Why are House Democrats so reluctant to tax wealth?

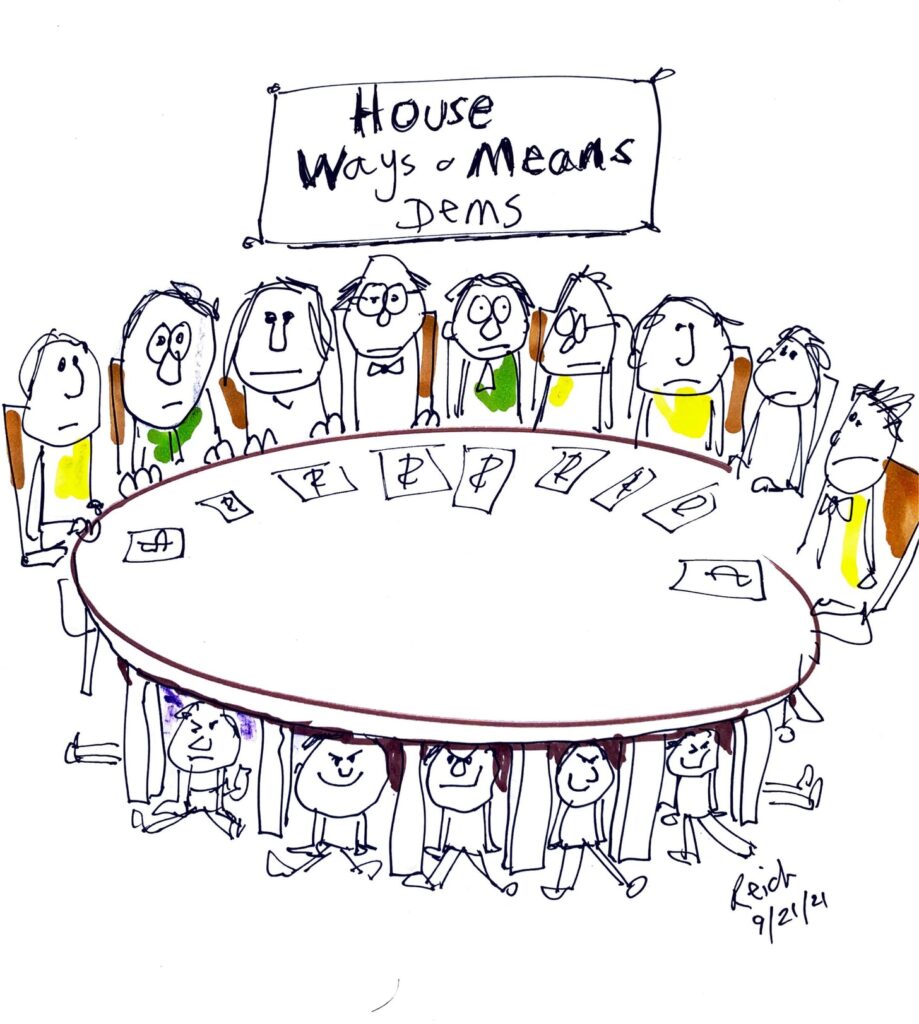

I have to get this off my chest. Last week, the House Ways and Means Committee released its proposed tax increases to fund President Biden’s $3.5 trillion social policy plan.

Here’s the big thing that hit me: Democrats didn’t go after the huge accumulations of wealth at the top – representing the largest share of the economy in more than a century.

You might have thought they’d be eager to tax America’s 660 billionaires whose fortunes have increased $1.8 trillion since the start of the pandemic – an amount that could fund half of Biden’s plan and still leave the billionaires as rich as they were before the pandemic began.

I mean, Elon Musk’s $138 billion in pandemic gains could cover the cost of tuition for 5.5 million community college students and feed 29 million low-income public-school kids, while still leaving Musk $4 billion richer than he was before Covid.

But House Democrats on Ways and Means decided to raise revenue the traditional way, taxing annual income rather than immense wealth. They aim to raise the highest income tax rate and apply a 3 percent surtax to incomes over $5 million.

Yet the dirty little secret – which House Democrats certainly know — is the ultra-rich don’t live off their paychecks.

Jeff Bezos’s salary from Amazon was $81,840 last year, yet he rakes in some $149,353 every minute from the soaring value of his Amazon stocks – which is how he affords five mansions, including one in Washington D.C. with 25 bathrooms.

House Democrats won’t even close the gaping “stepped-up basis at death” loophole, which allows the heirs of the ultra-rich to value their stocks, bonds, mansions, and other assets at current market prices — avoiding capital gains taxes on the entire increase in value from when they were initially purchased.

This loophole allows family dynasties to transfer ever larger amounts of wealth to future generations without it ever being taxed. Talk about an American aristocracy. We’re on the cusp of the largest inter-generational transfer of wealth in American history, as rich boomers pass it on to their millennial heirs. Closing this loophole may be our one big opportunity to stop this new aristocracy in its literal tracks.

Biden wanted to close this loophole, but House Democrats balked.

You might also have assumed they’d target America’s biggest corporations, awash in cash but paying a pittance in taxes. But remarkably, House Democrats have decided to set corporate tax rates below the level they were at when Barack Obama was in the White House. Hell, Democrats even kept a scaled-back version of private equity’s “carried interest.” And listen to this: they retained special tax breaks for oil and gas companies.

What’s going on here? It’s not that House Democrats lack the legislative power. They’re in one of those rare trifectas when they hold a majority of the House plusa bare majority of the Senate and the presidency.

It’s not the economics. Americans have been subject to decades of Republican “trickle-down” nonsense and know full well nothing trickles down. Billionaires hardly need to have their fortunes grow $100,000 a minute to be innovative. And as I’ve stressed, there’s more money at the top, relative to anywhere else, than at any time in the last century. Besides, Democrats need the revenue to finance their ambitious plan to invest in childcare, education, paid family leave, health care, and the climate.

Besides, Democrats need the revenue to finance their ambitious plan to invest in childcare, education, paid family leave, health care, and the climate.

So what’s holding them back?

Put simply, Democrats are reluctant to tax the record-breaking wealth of the rich and big corporations because of … the wealth of the rich and big corporations.

Many Democrats rely on that wealth to bankroll their campaigns. They also dread becoming targets of well-financed ad campaigns accusing them of voting for “job killing” taxes. (For the record, there’s no evidence that tax increases have “killed” jobs, especially when those tax increases have been targeted at higher incomes.)

Republicans have been in the pockets of moneyed interests at least since they championed Reagan’s tax cuts, regulatory rollbacks, and dismantling of labor protections. But the timidity of House Democrats shows just how loudly big money speaks these days even in the party of Franklin D. Roosevelt.

That’s partly because there’s so much less money on the other side. Through the first half of 2021, business groups and corporations spent nearly $1.5 billion on lobbying, compared to roughly $22 million spent by labor unions, and $81 million by public interest groups, according to OpenSecrets.org. Plus, the anti-taxers are well-organized. Thousands of industry groups, platoons of trade associations, every large corporation in America, along with small business associations — all are marching in step against corporate tax increases. There’s no similar pressure on the other side. How many pro-corporate-tax organizations can you name?

Progressive House Democrats will still have their say (AOC and other progressives will demand something more from the super-rich) and Senate Democrats haven’t yet weighed in (I’m sure Elizabeth Warren will continue to push her wealth tax).

But so far, the House Ways and Means Committee is where it all begins.

Let me step back a bit. The looming debate over taxes is really a debate over the allocation of wealth and power in America. As that allocation becomes ever more grotesquely imbalanced, this debate over wealth and power will loom ever larger over American politics.

Behind it will be this simple but important question: Which party stands up for average working people?

Democrats, take note.