Top economist warns 15% global minimum tax on corporations is ‘way too low’

From Common Dreams

University of California, Berkeley economist Gabriel Zucman, a leading expert on tax evasion, argued Wednesday that the 15% global minimum tax on multinational businesses pushed by the United States and endorsed by more than 100 countries is well below what’s needed to crack down on widespread corporate tax avoidance and redress longstanding inequities.

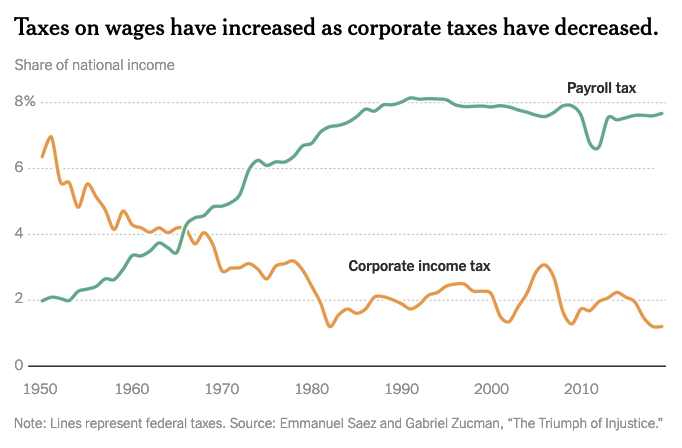

“President Biden should be applauded for trying to end the race to the bottom on corporate tax rates,” Zucman wrote in a New York Times op-ed with Times writer and graphics editor Gus Wezerek. According to the Tax Foundation, the average statutory corporate tax rate worldwide was 23.85% in 2020, down from 40.11% in 1980.

“For the Biden administration to give working families a real leg up, it should push Congress to enact a 25% minimum tax, which would bring in about $200 billion in additional revenue each year.” – University of California, Berkeley economist Gabriel Zucman, a leading expert on tax evasion.

But even if the U.S. Congress were to approve a 15% global minimum corporate tax rate, Zucman and Wezerek argued, it would not “be enough to close the growing economic gap between America’s rich and middle class.”

“Taxing multinationals at 15% would still leave them facing a lower rate than the average American pays in state and federal income tax,” the pair noted. “For the Biden administration to give working families a real leg up, it should push Congress to enact a 25% minimum tax, which would bring in about $200 billion in additional revenue each year. Over 10 years, that money would be more than enough to pay for nationwide high-speed internet, free community college, and universal preschool for 3- and 4-year-olds.”

“With a 25% minimum corporate tax,” they continued, “the Biden administration would begin to reverse decades of growing inequality. And it would encourage other countries to do the same, replacing a race to the bottom with a sprint to the top.”

The goal of a global minimum tax is to eliminate incentives for corporations to shift profits to overseas tax havens, which businesses use to avoid paying taxes in their home countries. Under a global minimum tax of 15%, U.S. multinationals that pay an effective 5% tax rate on profits parked in one of the world’s many tax havens would have to pay an additional 10% in taxes to the U.S. government, bringing the total to 15%.

The goal of a global minimum tax is to eliminate incentives for corporations to shift profits to overseas tax havens, which businesses use to avoid paying taxes in their home countries. Under a global minimum tax of 15%, U.S. multinationals that pay an effective 5% tax rate on profits parked in one of the world’s many tax havens would have to pay an additional 10% in taxes to the U.S. government, bringing the total to 15%.

In a series of tweets on Wednesday, Zucman argued that while it’s “a big deal” that the global minimum tax proposal is gaining momentum on the world stage, “the rate of 15% is way too low.”

Zucman’s appeal for a higher global minimum tax rate on multinational corporations came as U.S. Treasury Secretary Janet Yellen is reportedly planning to press the leaders of other rich nations to agree to a rate above the 15% floor that 130 OECD nations backed earlier this month.

Reuters reported Tuesday that Yellen has been working with congressional tax-writing committees to include a global minimum tax provision in a sweeping climate and infrastructure package that Democratic lawmakers hope to pass using the budget reconciliation process.

“Several countries were pushing for a rate above 15%, along with the United States,” Reuters noted, citing anonymous U.S. officials.

While economists and some advocacy groups have hailed progress toward a global minimum tax as highly encouraging, global humanitarian organizations and tax justice campaigners have warned that the framework endorsed by OECD nations would worsen inequities between rich and developing countries and let corporate behemoths such as Amazon off the hook.

Echoing Zucman’s call for a 25% global minimum tax, Oxfam International executive director Gabriela Bucher said last week that “the deal the OECD wants is skewed-to-the-rich and completely unfair.”

“Those who shamelessly rigged the global tax system to their benefit over a century ago have again ring-fenced the game for themselves,” Bucher added. “A global tax rate of 25% would raise nearly $17 billion more per year for the world’s poorest countries than a 15% rate―enough to vaccinate 80% of their population.”