Shameless in Tallahassee

I imagine some will describe the current battle between the Florida House and Senate over how to use the $1 billion budget surplus—to restore a portion of the social safety net or to cut taxes—as a “battle over the soul of the Republican Party.”

As if there has been anything close to a social safety net in Florida, ever. As if what passed for a safety net had not been shredded, time and again, for a generation thanks to the total dominance of Republican lawmakers in Tallahassee.

Lawmakers who have never seen a program for the poor, the powerless, the vulnerable they didn’t want to cut. Or a tax they didn’t want to lower or eliminate. Taxes needed to provide a decent level of wellbeing and dignity for the old, the sick, the disabled, the jobless.

As if the Republican party had a soul. This is the party that turned down billions in free federal Obamacare money just so that they wouldn’t have to bother to provide health care for a huge number of Floridians who can’t afford private health insurance.

“Florida’s tattered safety net,” reads the headline to a story that appeared Sunday in the Miami Herald. Battered would be a better word. What there had been of a safety net did not disintegrate from wear and tear. It was starved for funds actively and deliberately. None other than Tom Lee, the Republican chairman of the Senate budget committee told the paper: “We’ve cut taxes 50 times over the last 20 years.”

Programs for people that legislators evidently consider children of a lesser god—the economically disadvantaged, the incarcerated, even students in public schools—have borne the brunt of lower state revenue.

Recently, some Republicans have belatedly begun to realize that there is a limit to the long-running orgy of cuts. Also, there are some nasty unintended consequences to wielding the knife with abandon. Turning down big money to provide health care to the uninsured is not just senseless cruelty. It’s also stupid economically. A big influx of federal dollars into Florida would have helped the economy, including through what economists call the multiplier effect. It’s not a difficult concept. When people don’t have to spend their last dollar on health emergencies, they have more money to buy things like groceries and clothes. Supermarkets and retailers make more money, employ new workers, who in turn spend more money and so on down the line.

The state’s penny-wise, pound foolish policy hurts economically in another way. Healthy workers are more productive. They are more likely to show up for work every day, and when they are there they are more effective than those who are ailing. Rocket science this is not.

These are only one of the myriad ways Florida is shooting itself in the foot every day through its ideologically-driven, irrational miserliness. Things have gotten so out of hand that people who have always sided with the guys with the scissors are crying, “Enough!” Tax Watch, an organization described in the Herald piece as “a business-backed fiscal research group” recently came out with a report that details the long-term cost of neglect of just one of the elements of the safety net: child welfare.

Among the eye popping figures: there is a 37 percent annual turnover rate at the Department of Children and Families. That means not only that the state must spend $14 million yearly to train new child care workers but that many children, faced with an ever-changing cast of case workers, often never make it out of the foster care system. Only 4 percent of children that have had four or more workers make it out of foster care until they “age out” at 18. Meanwhile, each child in foster care costs the state $70,000 a year. And when they do age out, such children have a 65 percent chance of becoming homeless, among other calamities.

Outside the foster care system, the pre-K program is now funded below 2005 levels. FCAT data show that 43 percent of students in third grade read below grade level. Such students have a 400 percent higher chance of dropping out of school than other children. The Tax Watch report found a loss of $260,000 in lifetime earnings and taxes for each dropout.

At the other end of the age spectrum, things are just as bad. Last year, 6,000 elders died while waiting for state services. Virtually every other program has a long waiting list.

The horror stories frequently coming out of the prison system are no accident either. Prisons are so underfunded and chaotic that the Department of Corrections has a 50 percent turnover rate.

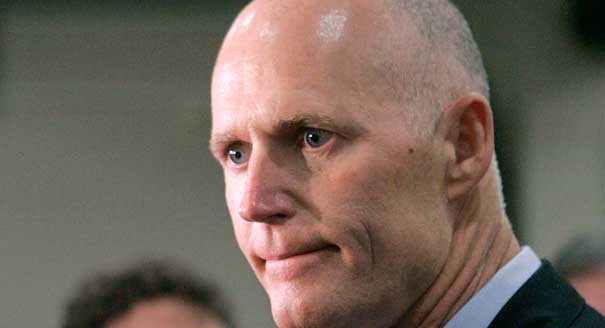

One person who has not gotten the message concerning the cost of repeatedly using the tax guillotine is Governor Rick Scott. He is satisfied with the status quo. The Governor this year tried to permanently eliminate corporate income taxes on manufacturers and retailers. The move, which would have cost the state $770 million a year, was too much even for the ultra-conservative House. It rejected it.

Now Scott is trying for another bite at the apple. He is proposing to use the $1 billion extra money the state has this year to cut taxes rather than begin repairing the across-the-board disaster wrought by massive cuts in programs. Who has been hurt the most? From the Miami Herald: “The hardest hit were the programs with the fewest advocates—health care for the poor, spending on the disabled, the elderly, and at-risk children, and the agencies that shoulder the unpopular job of policing prisoners.”

And who will get the lion’s share of the $1 billion bonanza Scott wants to dole out? Rich individuals and even richer corporations, naturally. The state of our state: unconscionable, shameful, revolting.