A tax bill from hell

Like NFL football teams desperately trying to win a few games at the end of the season to save face, the Republican Party, which so far has accomplished nothing after eleven months in control of Washington, is pushing hard to pass a tax bill at the last moment. Then they can call 2017 a good year.

There are so many things wrong with the GOP’s tax proposal that the Republicans should be ashamed to offer such a monstrosity. But shame is not part of the DNA of a party without a conscience.

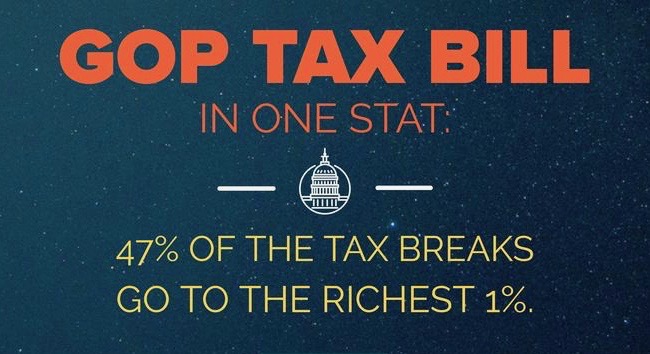

That both House and Senate versions of the Republican tax bill benefit mainly the very wealthy, big corporations, and the rich people who own large number of their stocks has been as solidly proved as the theory of evolution. So, I will just say one thing before moving on to other aspects of the bill. The Bible-thumping, God fearing people who make up such a key sector of the GOP base somehow missed the Biblical passage that speaks of a rich man, a camel, and the eye of a needle.

Despite the obvious upper-class bias of the tax bill, Republicans are still pretending it’s a middle-class tax cut. That says they think the politics of deception will work one more time. In fact, they are selling this tax bonanza for the rich using the same discredited arguments they used the last two times they shifted vast amounts of money from the rest of us to the one percent and the 10 percent. That was during the administrations of Ronald Reagan and George W. Bush, respectively.

Fool me once, shame on you. Fool me twice, shame on me, goes the saying. Fool me three times? There is no saying about that because it doesn’t happen often, but the Republicans are trying to pull off the hat trick with this tax bill.

There is nothing funny about robbing the poor to further enrich the wealthy but, parenthetically, the saying above reminds me of one of the most comical moments of the George W. Bush administration. That’s when the president tried to use the adage above but forgot the last part and, looking puzzled, blurted out “you can’t fool me twice.” Maybe laughing at the Republicans will helps get through their long reign of error.

George H. W. Bush called the kind of topsy-turvy rationale Republicans are using to sell their tax bill “voodoo economics.” That is unfair to voodoo, which is a rich system of belief and practice. A more accurate term would be bullshit economics (BSE). BSE not only has been disproven by history, it is inconsistent with basic facts, common sense and economic theory.

Lavishing big bucks on the wealthiest helps everybody, the BSE story goes. When corporations and the very wealthy get a big tax cut, they rush out to invest right and left, creating many new jobs, raising wages, and ultimately increasing tax revenues. Magic: cutting taxes raises tax revenues; benefitting the rich helps the middle class and the poor. A rising tide lifts all ships! Would you be interested in buying the Miami Circle?

The last two times this sort of thing was tried economic growth did not soar. The deficit did. The poor and the middle class did not do better. But the rich did very well indeed. Inequality went from scandalous to grotesque.

BSE is also shown to be false by what corporate CEOs themselves say. They are not going to invest more just because they get a tax cut. Overwhelmingly, they say tax rates are not a major consideration in investment decisions.

Here’s why. The central claim of BSE is that big tax cuts for the rich and big corporations will supercharge the economy by increasing investment, but the reality is that investors already have easy access to tons of money to invest. Some of the largest corporations are sitting on mounds of cash that for some reason they don’t care to invest. Moreover, money to invest is cheap because Interest rates are still low. To the extent there is insufficient investment, it’s not because money is scarce but because there is not enough demand to justify new investment. You don’t buy equipment to make things you can’t sell.

Consumer spending is the main driver of the American economy. For decades, the earnings of the bottom 90 percent of American workers have either barely increased, flatlined, or declined. There are just not enough consumers with the spending power to buy all the new toys American companies could produce. Tax cuts for the rich will not improve this picture. It will make it worse by further squeezing the mass of consumers. No doubt, some will spend even if they don’t have the money, but that’s a formula for another big debt crisis like that in 2008.

I doubt many Republicans believe their own story. So why do they want this tax bill so badly? One big reason is donors. Republicans get most of their money from the most selfish among the rich and the most backward corporations. These people bet their money on the Republican Party and now they want their cut of the spoils of victory.

The other reason Republicans want this tax bill come hell or high water is their cynical use of deficits. Verbally, they deplore them. In reality, they approve if they are used for tax cuts for the rich or colossal military spending but not if they pay for, say, children’s health care. And for Republicans deficits are the gift that gives on giving. Once they have created huge deficits, Republicans can turn around and use them to squeeze social spending harder.

Cynicism has always been part of politics. But this generation of Republicans has taken cynicism to new heights.